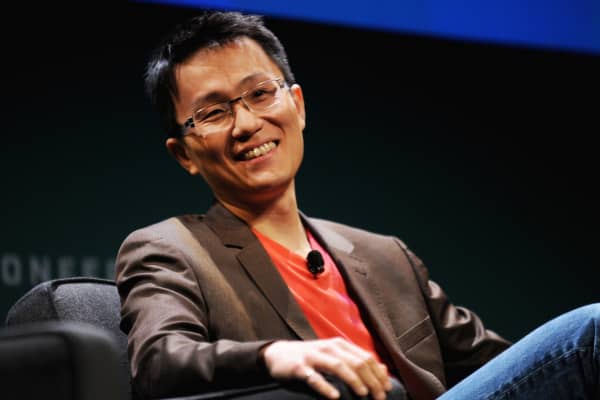

Allen Lau, CEO of the fast-growing storytelling app Wattpad, believes running his company in Toronto gives him an unfair advantage over his entrepreneurial counterparts in Silicon Valley. In Silicon Valley, where he ran a previous company, he’d be vying for engineers against Google and Facebook.

“To compete in that environment for the best talent would be very, very fierce,” says Lau. “In a smaller pond we are the bigger fish. That helps us attract the best possible talent.”

That talent has helped him attract more than $66 million in venture capital and grow his digital community to 45 million users over the last 10 years. With 130 employees and revenue growing 30 percent year-over-year, Lau says, “we are very determined to build this company in Toronto. We have no plan to open up another office elsewhere, except salespeople.”

Lau is a well-known presence on Toronto’s fast-growing start-up scene, where by all accounts excitement about entrepreneurship is percolating as it never has before. There are currently between 2,100 and 4,100 active tech start-ups in Toronto’s ecosystem, according to a report by Tech Toronto, a community for entrepreneurs. Toronto and the cities immediately surrounding it had a population of 5.4 million people in 2015.

A confluence of factors is shaping the entrepreneurial ecosystem in the fourth-largest city in North America. One driver is the city’s engineering talent pool. There are 150,000 full-time students enrolled in universities throughout the Greater Toronto area. In addition, the federal and provincial governments offer strong support for technology innovation and financial assistance. Start-ups are also supported by a robust venture capital community.

More than $2 billion in venture capital was disbursed in Canada in 2016 — a 15 percent increase over 2016 and the most funding since 2002, when the number hit $2.7 billion, according to the Canadian Venture Capital & Private Equity Association. Toronto has benefited. It was home to Canada’s biggest venture deal of 2016. Thalmic Labs, a maker of wearable technologies based in Kitchener, Ontario, near Toronto, corralled $120 million in a series B round in September from investors, including Intel Capital, The Amazon Alexa Fund and Fidelity Investments Canada.

With the action showing no signs of slowing and Toronto start-ups standing out in areas such as artificial intelligence, many local players say they’re not interested in turning the city into the next Silicon Valley. “I think Toronto at some level really wants to be the first Toronto,” says Ameet Shah, a partner at Golden Venture Partners, a seed-stage fund in Toronto whose start-up Five Mobile was acquired by Zynga in July 2011. “We hate being called Silicon Valley North.”

Paying it forward

So why is entrepreneurship percolating in the city now? “It’s a convergence of momentum,” says Craig Morantz, an angel investor in the Toronto area who previously served as CEO of Kira Talent, a locally based start-up that offers a video admissions platform for colleges.

One important catalyst has been the critical mass of successful Canadian tech firms, such as Shopify, Hootsuite, Kik and D2L, with offices in the city, alongside U.S. companies such as Facebook, Twitter and Google. “You build some anchor-tenant companies, they scale up, and the talent goes on to start other companies,” says Mike McDerment, CEO of FreshBooks, an accounting software provider based in Toronto.

When this seasoned talent starts companies, a growing number of angels are raring to help them get started. “More money is available at earlier stages — pre-seed, seed and series A,” says Shah.

With the Silicon Valley market increasingly frothy, deal-hungry venture capitalists, both from within Canada and in the United States, have also cast eyes on Toronto. “Motivated U.S. investors realize there are some really great companies up here — and are coming looking for them,” says Mark MacLeod, founder of SurePath Capital Partners, a strategic advisory firm to the global small-business software market based in Toronto. He is often contacted by investors looking to check out interesting companies in the city over a day or two — which he says is easy to arrange.

“Motivated U.S. investors realize there are some really great companies up here — and are coming looking for them.”-Mark MacLeod, founder of SurePath Capital Partners

“Capital doesn’t really care about borders,” says McDerment. “It’s a really good environment to make an investment.” His firm raised $30 million in 2014 from Oak Investment Partners, a firm with offices in Palo Alto, California, and Greenwich, Connecticut, with participation from Atlas Ventures in Cambridge, Massachusetts, and Georgian Partners, a Toronto firm.

And as more area start-ups evolve into scale-ups and get acquired, local entrepreneurs have developed a greater sense of what is possible, say observers. McDerment points to Bump Technologies’ acquisition by Google in 2013 and Rypple’s acquisition by Salesforce in 2011. “The thing people don’t know about Toronto is how many great exits have happened,” he says.

Fortunately for fast-growing start-ups, engineers are abundant, thanks to the presence of RIM (Blackberry) and schools such as University of Waterloo, known for its prestigious engineering school, and University of Toronto. And it costs less to hire them than comparable professionals from Silicon Valley.

“I can hire a very senior Canadian engineer for $70,000 U.S. dollars,” says Morantz. “You can’t even get someone to return your call in New York or Boston unless it’s $100,000 or $200,000.”

It helps that Toronto’s cost of living is lower than that of New York’s pricier tech hubs. “Although it’s not a cheap city to live, it’s still affordable,” says Morantz. “It’s not San Francisco. It’s not New York.”

Toronto is also very diverse, with 49 percent of the population made up of immigrants, according to Tech Toronto. “Having that kind of diversity helps you build great companies,” says Morantz. “When you’ve got someone who is maybe first or second generation, they are coming to the table with a unique perspective.”

The city also has a thriving infrastructure to nurture start-ups, with hubs including DMZ, a technology incubator at Ryerson University, and MaRS, which helps connect start-ups in information and communications technology, cleantech and health with funding and advice. “The communities in the last two to three years have really matured,” says Kevin Kimsa, general partner at ScaleUP Ventures, a venture fund in Toronto. “It has really acted as a catalyst for more innovation to hit the ground running.”

More from iCONIC:

Baltimore is making a $5 billion bet that entrepreneurs can revive the city

Billionaire closer to mining the moon for trillions of dollars in riches

CEO who turned $345 into $30 million: Stop drooling over Silicon Valley and get to work

Toronto’s entrepreneurial ecosystem still has some obstacles to cross. Other than OMERS Ventures, the venture capital arm of Canada’s largest pension fund, and Georgian Capital, “there is not a ton of late-stage capital,” says MacLeod. “Most of the companies that are really into expansion will need to raise that capital from the U.S.”

But at the moment, that doesn’t seem to be deterring any start-up activity.

“Something has really changed the last couple of years,” says Ben Baldwin, founder of ScaleDriver, a Toronto management consultancy that advises executives on building innovation, and founder of the Founder City Project, a network of start-up and scale-up founders.

“Canadians are kind of rubbing their hands together like evil scientists,” he said. “They are going to make a major impact.”

— By Elaine Pofeldt, special to CNBC.com